10 Essential Tips for Your Investment Property Checklist

Toronto and its neighbouring cities like Oshawa, Whitby, Ajax, and Pickering keep drawing real estate investors hoping for steady returns. People are often amazed that professional property management services typically charge between 8% to 12% of monthly rental income, which can seem steep at first. Yet, some of the savviest investors treat that cost as a smart savings move, not just another expense. The reason? Knowing all the hidden details in the investment property checklist can make or break your success, and most people miss them.

Table of Contents

- Understand Your Investment Goals

- Research Local Real Estate Markets

- Calculate Potential Returns On Investment

- Get Financing Pre-Approval

- Find A Reliable Real Estate Agent

- Inspect The Property Thoroughly

- Understand Legal Requirements And Zoning

- Calculate Property Management Costs

- Plan For Maintenance And Repairs

- Evaluate Your Exit Strategy

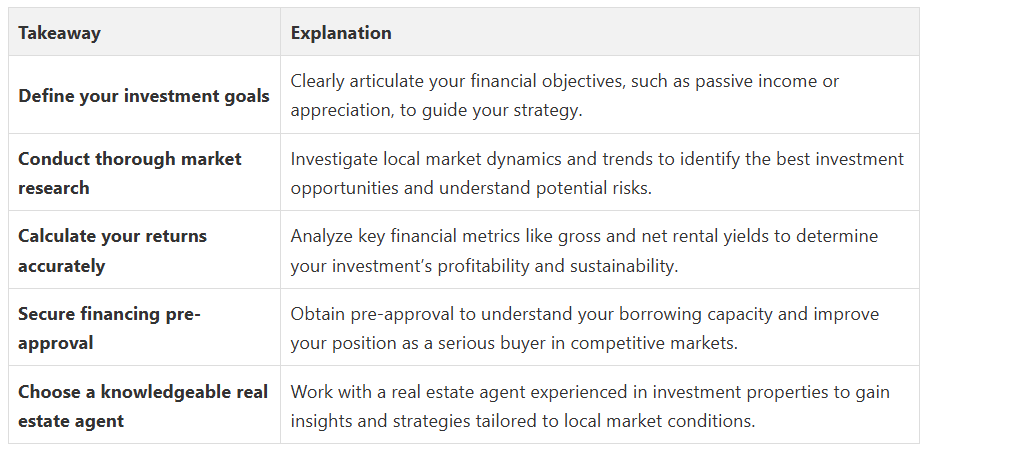

Quick Summary

1: Understand Your Investment Goals

Real estate investment isn’t a one-size-fits-all strategy. Each investor has unique objectives that will shape their approach. Before diving into property selection, you need to articulate your specific aims. Are you seeking long-term appreciation, monthly rental income, or a combination of both? Learn more about investment strategies that can guide your decision-making process.

Key investment goals typically include:

- Passive Income Generation: Creating steady monthly revenue through rental properties

- Capital Appreciation: Buying properties in areas with strong potential for value increase

- Wealth Building: Using real estate as a long-term investment vehicle

- Tax Benefits: Leveraging property ownership for potential tax advantages

Whether you’re a first-time investor or expanding an existing portfolio, taking time to clearly define your investment goals is the critical first step in your investment property checklist. This foundational work will inform every subsequent decision, from property selection to financing approach.

2: Research Local Real Estate Markets

Understand the local market dynamics before making any investment decisions. Each neighbourhood in Oshawa, Whitby, Ajax, Pickering, and the surrounding areas has its own distinct characteristics that can significantly impact investment potential.

Key areas to investigate include:

- Rental Demand: Current occupancy rates and potential tenant demographics

- Price Trends: Historical and projected property value appreciation

- Economic Indicators: Local job market, infrastructure developments, and population growth

Property investors should pay close attention to:

- Future urban development plans

- Local employment sector stability

- Infrastructure and transportation improvements

- Proximity to amenities and schools

3: Calculate Potential Returns on Investment

Return on Investment (ROI) goes beyond simple profit calculations. It requires a comprehensive analysis of both immediate and long-term financial potential. Explore detailed investment calculations to understand the nuanced aspects of real estate investing.

Key financial metrics to consider include:

- Gross Rental Yield: Annual rental income divided by property purchase price

- Net Rental Yield: Rental income minus expenses, divided by property purchase price

- Appreciation Potential: Projected property value increase over time

- Local market appreciation rates

- Typical maintenance and operating costs

- Potential tax implications

Fanis Makrigiannis recommends creating multiple financial scenarios to understand potential outcomes. Conservative estimates help protect your investment strategy, ensuring you can weather market fluctuations and unexpected challenges in the Toronto and Durham region real estate markets.

4: Get Financing Pre-Approval

Financing pre-approval provides a clear understanding of your borrowing capacity and demonstrates serious intent to sellers. In competitive markets like Oshawa, Whitby, Ajax, and Pickering, having a pre-approval can give you a significant advantage.

Critical documents you’ll need for pre-approval include:

Lenders evaluate several key factors when considering investment property financing. They will closely examine your credit score, debt-to-income ratio, and overall financial stability. A Real Estate Agent in Oshawa can help you prepare a compelling financial profile that increases your chances of securing favourable financing terms.

- Proof of income (T4 slips, tax returns)

- Credit history and credit score

- Down payment verification

- Existing debt and financial obligations

Important considerations for investment property financing:

- Investment properties typically require higher down payments

- Interest rates may be slightly higher than residential mortgages

- Lenders often require more extensive documentation

5: Find a Reliable Real Estate Agent

A knowledgeable Real Estate Agent in Oshawa brings specialized expertise that goes far beyond basic property listings. They provide critical insights into local market trends, investment potential, and negotiation strategies specific to investment properties.

Key qualities to seek in an investment-focused real estate agent include:

- Proven track record in investment property transactions

- Deep understanding of local market dynamics

- Strong network of professional connections

- Advanced analytical skills for evaluating property potential

- Identify properties with strong appreciation potential

- Understand neighbourhood development plans

- Calculate accurate rental yield projections

- Navigate complex investment financing options

Fanis Makrigiannis understands that successful real estate investing demands more than transactional expertise. It requires a partner who can provide strategic guidance, market insights, and a comprehensive understanding of investment property dynamics in the Toronto and Durham region markets.

6: Inspect the Property Thoroughly

Professional property inspections go far beyond a casual walkthrough. They provide a detailed assessment of the property’s structural integrity, potential maintenance requirements, and underlying problems that could impact your investment returns.

Critical areas to examine during a property inspection include:

- Foundation and structural integrity

- Electrical and plumbing systems

- Roof condition and potential repair needs

- Signs of water damage or moisture issues

Key considerations during property inspection:

- Potential renovation or upgrade costs

- Energy efficiency and potential utility expenses

- Compliance with local building codes

- Environmental hazards or potential structural problems

Fanis Makrigiannis recommends treating property inspection as a critical due diligence process. The insights gained can save you significant money and prevent potential headaches in your Toronto and Durham region real estate investment journey.

7: Understand Legal Requirements and Zoning

Zoning regulations dictate how properties can be used, developed, and modified. These complex legal frameworks vary significantly between municipalities and can dramatically impact your investment strategy. A Real Estate Agent in Oshawa can help you interpret these intricate local regulations.

Key legal considerations for investment properties include:

- Permitted property usage types

- Rental restrictions and regulations

- Building height and density limitations

- Potential future development plans in the area

- Short-term rental permissions

- Secondary suite or basement apartment regulations

- Home-based business restrictions

- Historic preservation requirements

Careful examination of legal requirements protects your investment and prevents potential future conflicts. Understanding these regulations is not just about compliance, but about maximizing your property’s potential in the Toronto and Durham region real estate markets.

8: Calculate Property Management Costs

Property management expenses extend far beyond basic maintenance and can significantly impact your overall investment returns. A Real Estate Agent in Oshawa can help you develop a detailed cost analysis that accounts for both expected and unexpected expenditures.

Typical property management costs include:

- Regular maintenance and repairs

- Property taxes and insurance

- Utility expenses

- Potential vacancy periods

- Reducing tenant turnover

- Handling maintenance efficiently

- Screening potential tenants

- Managing legal compliance

Fanis Makrigiannis recommends creating a comprehensive financial buffer that accounts for potential market fluctuations and unexpected expenses. Understanding the full spectrum of property management costs is crucial for sustainable success in the Toronto and Durham region real estate markets.

Discover comprehensive home maintenance strategies to protect your real estate investment.

Proactive maintenance prevents costly emergency repairs and preserves your property’s long-term value. According to recent housing surveys, nearly one-quarter of properties require ongoing maintenance attention.

Critical areas to monitor and maintain include:

- Roofing and exterior structure

- Plumbing and electrical systems

- HVAC equipment

- Foundation and structural integrity

Consider creating a maintenance schedule that includes:

- Seasonal inspections

- Regular professional assessments

- Preventive maintenance tasks

- Emergency repair fund

10: Evaluate Your Exit Strategy

Exit strategies are not just afterthoughts but fundamental components of successful real estate investing. They provide a clear roadmap for how and when you will ultimately convert your property investment into liquid assets.

Potential exit strategy options include:

- Selling the property at the market peak

- Refinancing to extract equity

- Converting to a long-term rental

- Passing the property to family members

Key considerations for your exit strategy:

Fanis Makrigiannis recommends developing flexible exit strategies that can adapt to changing market conditions in the Toronto and Durham region. A well-planned exit approach transforms your investment from a simple property purchase into a strategic financial instrument.

- Current market valuation

- Potential future appreciation

- Tax implications of selling

- Personal financial goals

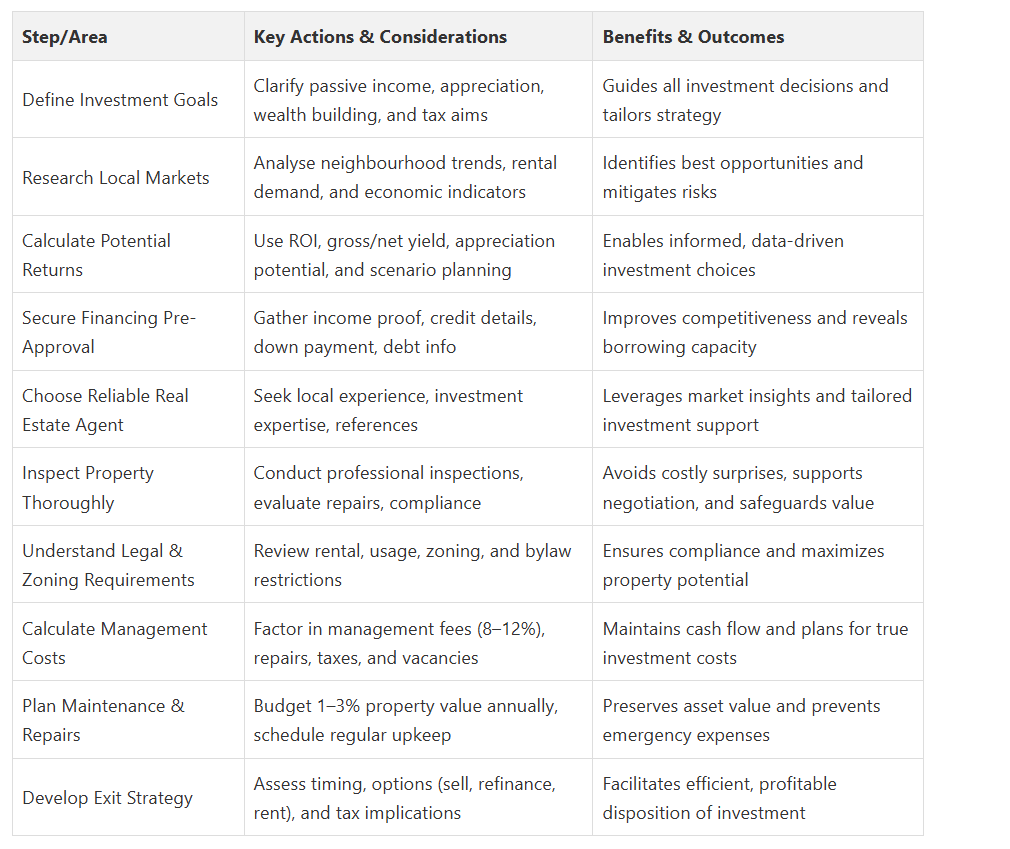

Below is a comprehensive table summarizing the 10 essential tips for building your investment property checklist, capturing the key steps, considerations, and benefits covered in the article.

Ready to Take the Stress Out of Real Estate Investing in Toronto and Durham?

Let Fanis Makrigiannis and https://fanis.ca become your trusted resource. Explore comprehensive property listings and exclusive neighbourhood insights. Discover easy-to-use tools and personalized strategies tailored to the goals you identified in your checklist. Take the first step by booking a no-obligation consultation with Fanis today and secure your advantage before the next property hits the market. Act now and move forward with confidence in your investment journey.

Frequently Asked Questions

How do I effectively research local real estate markets?

What financial metrics should I consider when calculating potential returns on investment?

Why is financing pre-approval important for real estate investments?

Contact me personally to learn more.

About the author:

Fanis Makrigiannis is a trusted Realtor with RE/MAX Rouge River Realty Ltd., specializing in buying, selling, and leasing homes, condos, and investment properties. Known for his professionalism, market expertise, and personal approach, Fanis is a Real Estate agent in the Durham region and is committed to making every real estate journey seamless and rewarding.

He understands that each transaction represents a significant milestone and works tirelessly to deliver outstanding results.

With strong negotiation skills and a deep understanding of market trends, Fanis fosters lasting client relationships built on trust and satisfaction.

Proudly serving the City of Toronto • Ajax • Brock • Clarington • Oshawa • Pickering • Scugog • Uxbridge • Whitby • Prince Edward County • Hastings County • Northumberland County • Peterborough County • Kawartha Lakes

Fanis Makrigiannis

Real Estate Agent

RE/MAX Rouge River Realty LTD

(c): 905.449.4166

(e): info@fanis.ca

Recommended

7 Essential Home Maintenance Checklist Steps for 2025 - Fanis Makrigiannis Realtor®

7 Essential Tips for New Homeowners in Canada - Fanis Makrigiannis Realtor®

Top Property Inspection Tips for Toronto & Durham Region 2025 - Fanis Makrigiannis Realtor®

Air Duct Inspection Checklist 2025 for Texas Homeowners - Green Home Services

The 5 Golden Rules to buy an apartment in Cannes - Living on the Côte d’Azur