Understanding Real Estate Exit Strategies for Success

Selling a home in Toronto or the Durham region is about much more than just sticking a sign on the lawn. Sure, lots of people believe a quick sale means quick cash, done deal. But the real surprise is that having no clear exit strategy often leads sellers to miss out on significant profits, or even get stuck with unwanted tax bills. Most investors who map out their exit strategy early can increase their returns by thousands of dollars compared to those who don’t. That twist alone turns every transaction into a high-stakes strategic decision worth thinking twice about.

Table of Contents

- Defining Real Estate Exit Strategies: What Are They?

- The Core Concept of Exit Strategies

- Types of Real Estate Exit Strategies

- The Importance of Exit Strategies in Real Estate Transactions

- Risk Management and Financial Protection

- Strategic Financial Optimization

- Types of Real Estate Exit Strategies: Understanding Your Options

- Traditional Sales and Immediate Liquidation

- Advanced Investment Exit Approaches

- Evaluating Market Conditions: How They Influence Exit Strategies

- Economic Indicators and Market Dynamics

- Strategic Decision Making in Volatile Markets

- Key Considerations for Choosing the Right Exit Strategy

- Personal Financial Objectives

- Property-Specific Evaluation Criteria

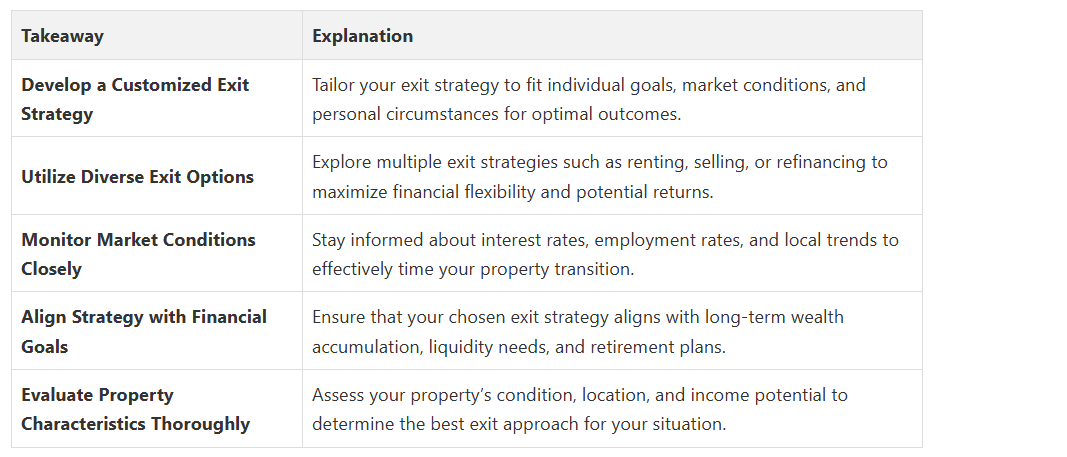

Quick Summary

Defining Real Estate Exit Strategies: What Are They?

The Core Concept of Exit Strategies

Key Characteristics of Effective Exit Strategies Include:

- Maximizing potential property value

- Minimizing potential financial risks

- Aligning with personal financial timelines

- Adapting to changing market dynamics

Types of Real Estate Exit Strategies

- Sell and Upgrade: Selling a current property to purchase a more valuable or suitable home

- Rental Conversion: Transforming a property into a rental asset to generate ongoing income

- Refinancing: Accessing home equity while maintaining property ownership

- Wholesale Property Transfer: Quickly selling a property to another investor

Successful real estate exit strategies require comprehensive market knowledge, financial planning, and an understanding of local real estate trends. Property owners must evaluate their long-term goals, current market conditions, and potential future developments to craft an effective strategy.

The Importance of Exit Strategies in Real Estate Transactions

Risk Management and Financial Protection

Critical Risk Mitigation Elements Include:

- Identifying potential market downturns

- Establishing clear financial thresholds

- Creating flexible transition plans

- Maintaining financial liquidity

Learn about potential transaction challenges to better understand the complexities of strategic property management. As a Real Estate Agent in Oshawa, Fanis Makrigiannis Realty recognizes that proactive planning is essential in navigating real estate investments.

Strategic Financial Optimization

- Maximize potential property appreciation

- Align investment timelines with personal financial goals

- Create multiple potential exit pathways

- Minimize tax implications during property transitions

Ultimately, a well-crafted exit strategy transforms real estate from a mere transaction into a strategic financial instrument. Property owners who invest time in developing these plans position themselves to make informed decisions, capitalize on market opportunities, and protect their long-term financial interests.

Types of Real Estate Exit Strategies: Understanding Your Options

Traditional Sales and Immediate Liquidation

- Current market pricing

- Property condition and potential renovations

- Timing of sale relative to market trends

- Potential capital gains tax implications

Explore confident real estate buying strategies to understand how strategic planning can enhance your investment approach. As a Real Estate Agent in Oshawa, Fanis Makrigiannis Realty recognizes the importance of tailored exit planning.

Advanced Investment Exit Approaches

- Rental Property Conversion: Transforming the property into a rental asset to generate ongoing income

- 1031 Exchange: Deferring capital gains tax by reinvesting proceeds into another investment property

- Seller Financing: Offering personal financing to potential buyers to expand market opportunities

- Partial Property Sale: Selling a portion of the property to unlock equity while maintaining ownership

Ultimately, successful real estate exit strategies demand comprehensive market knowledge, financial acumen, and the ability to adapt to changing economic landscapes. Property owners who approach their investments with flexibility and strategic thinking can transform real estate from a simple asset into a powerful financial instrument.

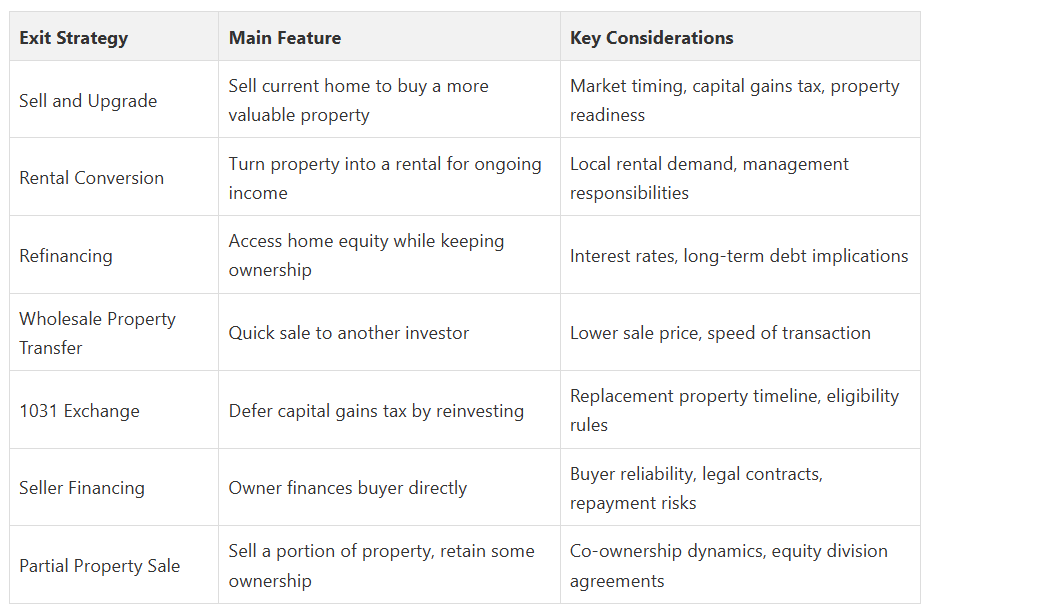

To help clarify the different real estate exit strategies discussed in this article, the following table compares popular approaches, their core features, and key considerations.

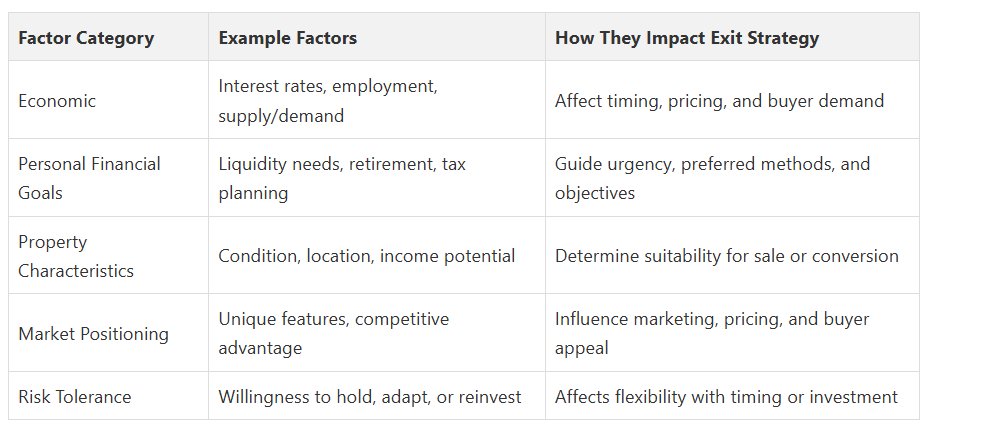

Evaluating Market Conditions: How They Influence Exit Strategies

Market conditions play a pivotal role in determining the effectiveness and timing of real estate exit strategies for property owners in Toronto, Pickering, Oshawa, Whitby, Ajax, and surrounding areas. Understanding these dynamic factors helps investors make informed decisions that maximize their potential returns and minimize financial risks.

Economic Indicators and Market Dynamics

- Interest rate fluctuations

- Local employment rates

- Population growth trends

- Regional economic development

- Housing supply and demand

Explore key economic factors to gain deeper insights into market performance. As a Real Estate Agent Oshawa, Fanis Makrigiannis Realty understands the nuanced relationship between economic indicators and real estate opportunities.

Strategic Decision Making in Volatile Markets

- Timing: Identifying optimal selling windows

- Valuation: Understanding property worth relative to current market trends

- Risk Management: Developing contingency plans for potential market shifts

- Opportunity Recognition: Identifying emerging market opportunities

Ultimately, market conditions are not obstacles but valuable information sources that guide strategic decision-making. Property owners who develop a nuanced understanding of economic indicators can craft exit strategies that not only protect their investments but also capitalize on emerging opportunities in the dynamic real estate landscape.

Key Considerations for Choosing the Right Exit Strategy

Personal Financial Objectives

Crucial personal factors to evaluate include:

- Long-term wealth accumulation goals

- Immediate liquidity requirements

- Retirement planning considerations

- Tax efficiency strategies

- Personal risk tolerance levels

Learn about retirement home selling strategies to understand how personal financial goals shape exit planning. As a Real Estate Agent in Oshawa, Fanis Makrigiannis Realty recognizes the unique financial journey of each property owner.

- Property Condition: Current state and potential renovation requirements

- Location Value: Neighbourhood desirability and future development potential

- Market Positioning: Competitive advantages and unique selling propositions

- Income Generation Potential: Rental or alternative revenue streams

Ultimately, choosing the right exit strategy is not a one-size-fits-all proposition. It requires a sophisticated understanding of personal financial landscapes, property dynamics, and broader market conditions. Property owners who invest time in a comprehensive analysis position themselves to make informed decisions that maximize their real estate investments.

Unlock Your Perfect Real Estate Exit Strategy—Start With Local Expertise

Your situation deserves personalized guidance. At https://fanis.ca, you gain access to local market expertise and tailored solutions from Fanis Makrigiannis, a trusted Realtor® who understands how to match your goals with the right plan. Ready to move forward? Contact Fanis today for a confidential discussion, or discover how strategic property planning can enhance your results. Now is the time to secure your financial future and step confidently into your next chapter.

Frequently Asked Questions

Why is having an exit strategy important in real estate?

What are common types of real estate exit strategies?

How do market conditions affect real estate exit strategies?

Contact me personally to learn more.

About the author:

Fanis Makrigiannis is a trusted Realtor with RE/MAX Rouge River Realty Ltd., specializing in buying, selling, and leasing homes, condos, and investment properties. Known for his professionalism, market expertise, and personal approach, Fanis is a Real Estate agent in the Durham region, is committed to making every real estate journey seamless and rewarding.

He understands that each transaction represents a significant milestone and works tirelessly to deliver outstanding results.

With strong negotiation skills and a deep understanding of market trends, Fanis fosters lasting client relationships built on trust and satisfaction.

Proudly serving the City of Toronto • Ajax • Brock • Clarington • Oshawa • Pickering • Scugog • Uxbridge • Whitby • Prince Edward County • Hastings County • Northumberland County • Peterborough County • Kawartha Lakes

Fanis Makrigiannis

Real Estate Agent

RE/MAX Rouge River Realty LTD

(c): 905.449.4166

(e): info@fanis.ca