Rental Property Basics in Ontario

Rental properties are shaping the financial strategies of thousands of Ontarians and becoming a core part of real estate decisions from Oshawa to Toronto. Now get this. Strategic real estate investments in Canada have consistently outperformed many traditional investments, providing reliable passive income and property appreciation. Most people think buying a rental property is all about collecting monthly cheques. Still, the real advantage comes from understanding the surprising local trends and rules that determine who really wins in the market.

Table of Contents

- What Are Rental Properties And Their Types?

- Residential Rental Property Categories

- Investment Considerations

- Why Rental Properties Matter For Investors And Homeowners

- Financial Wealth Generation

- Risk Mitigation And Portfolio Diversification

- How Rental Properties Generate Income

- Primary Income Streams

- Strategic Income Optimization

- Key Concepts In Rental Property Management

- Legal And Compliance Framework

- Property Maintenance And Tenant Relations

- Understanding The Rental Market In Toronto And Durham Region

- Market Dynamics And Trends

- Investment Considerations

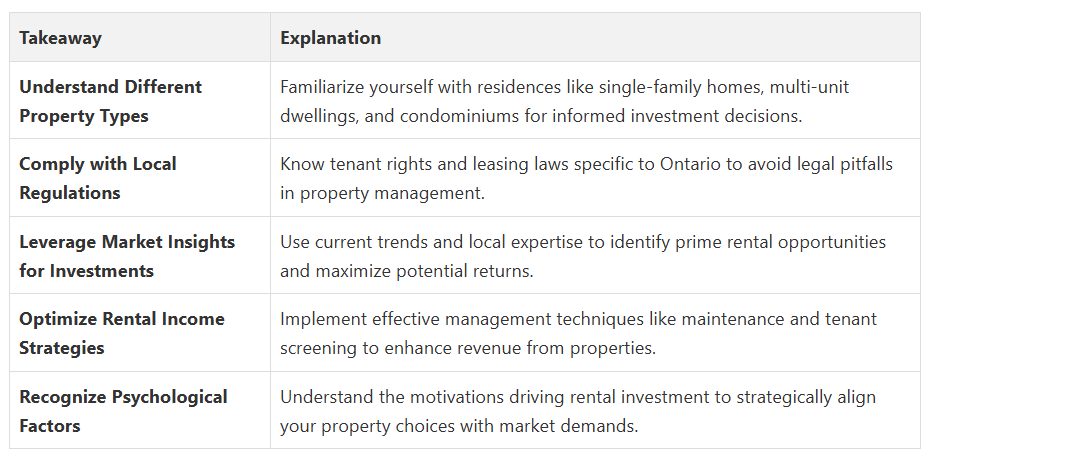

Quick Summary

What Are Rental Properties and Their Types?

Rental properties represent real estate investments where property owners generate income by leasing residential or commercial spaces to tenants. In the Ontario housing market, understanding rental property basics requires exploring the diverse landscape of property types and investment strategies.

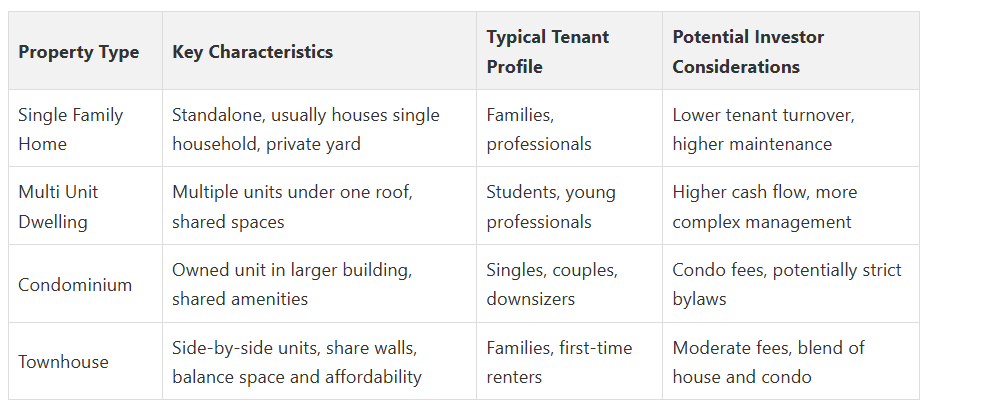

Residential Rental Property Categories

Residential rental properties in Toronto, Oshawa, Whitby, Ajax, and Pickering come in several distinctive formats that appeal to different investor profiles and tenant needs:

Each property type presents unique advantages and challenges for real estate investors.

- Single Family Homes: Standalone residential properties leased to individual tenants or families

- Multi-Unit Dwellings: Properties containing multiple separate residential units under one roof

- Condominiums: Individually owned units within a larger building complex available for rental

- Townhouses: Connected residential units offering a blend of apartment and house living characteristics

To help clarify the types of residential rental properties available in Ontario, the following table outlines key characteristics and potential investor considerations for each category.

A Real Estate agent in Oshawa can help navigate these nuanced investment opportunities with professional insights.

Investment Considerations

Successful rental property ownership requires a comprehensive understanding of local regulations, market dynamics, and financial implications. According to Ontario’s residential tenancy guidelines, investors must comply with specific legal frameworks governing tenant rights, lease agreements, and property maintenance standards.

While Fanis Makrigiannis Realty does not directly manage rental properties, our team provides valuable market insights for potential real estate investors exploring rental property opportunities in the Durham Region and Greater Toronto Area. Understanding local market trends, potential rental yields, and neighbourhood characteristics becomes crucial for making informed investment decisions.

Psychologically, rental property investment taps into powerful motivations of financial security, passive income generation, and long-term wealth building. Successful investors recognize that strategic property selection goes beyond mere transaction metrics and requires a deep understanding of local community dynamics and emerging housing trends.

Why Rental Properties Matter for Investors and Homeowners

Rental properties represent more than just financial assets. They are strategic economic instruments that offer multiple advantages for investors and homeowners in the dynamic real estate markets of Toronto, Durham Region, Oshawa, Whitby, Ajax, and Pickering.

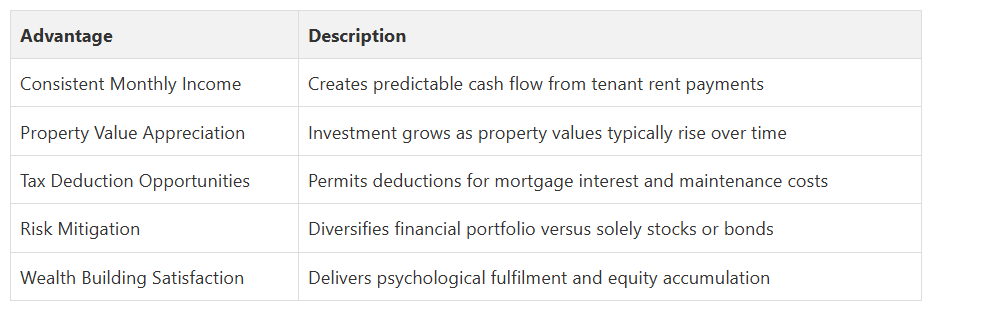

Financial Wealth Generation

Investing in rental properties provides robust opportunities for long-term financial growth. Key financial benefits include:

- Consistent Monthly Income: Regular rental payments create predictable revenue streams

- Property Value Appreciation: Real estate assets typically increase in market value over time

- Tax Deduction Opportunities: Mortgage interest, maintenance costs, and property management expenses can offer significant tax advantages

Risk Mitigation and Portfolio Diversification

Rental properties provide a unique mechanism for spreading financial risk across different asset classes. By exploring diversification strategies, investors can create resilient investment portfolios that withstand market fluctuations.

Homeowners can leverage rental properties as additional income sources, transforming residential assets into powerful wealth-building tools. The psychological satisfaction of generating passive income while building equity makes rental property investments particularly attractive.

This table summarizes the primary financial benefits and protective features of rental property investment, allowing Ontarians to quickly compare the distinct advantages discussed in the article.

Understanding local market dynamics becomes crucial. Fanis Makrigiannis Realty provides expert insights into neighbourhood trends, helping investors make informed decisions that maximize potential returns while minimizing potential risks in the competitive Ontario real estate landscape.

How Rental Properties Generate Income

Rental properties transform real estate assets into dynamic income streams, creating financial opportunities for investors across Toronto, Durham Region, Oshawa, Whitby, Ajax, and Pickering. Understanding the intricate mechanisms of income generation becomes crucial for strategic real estate investment.

Primary Income Streams

Rental properties generate revenue through multiple interconnected channels that provide consistent financial returns:

- Monthly Rental Payments: Primary income source from tenants paying the agreed monthly rent

- Long Term Appreciation: Gradual increase in property market value

- Tax Deduction Benefits: Potential financial advantages through legitimate expense claims

Strategic Income Optimization

Successful rental property investors recognize that income generation extends beyond simple rent collection. Explore essential investment property strategies to maximize financial returns.

A Real Estate agent in Oshawa can help investors understand nuanced income optimization techniques. These strategies might include:

- Selecting properties in high-demand neighbourhoods

- Maintaining properties to attract quality long-term tenants

- Understanding local market rental rate trends

Key Concepts in Rental Property Management

Rental property management represents a sophisticated discipline requiring strategic planning, legal understanding, and proactive communication across Toronto, Durham Region, Oshawa, Whitby, Ajax, and Pickering real estate markets.

Legal and Compliance Framework

Successful property management hinges on a comprehensive understanding of legal obligations and tenant rights. Critical compliance areas include:

- Lease Agreement Structures: Detailed, legally compliant contracts protecting both landlord and tenant interests

- Rental Regulations: Adherence to Ontario’s Residential Tenancies Act

- Documentation Management: Systematic record keeping of communications, maintenance, and financial transactions

Property Maintenance and Tenant Relations

Check out our essential property management tips to understand the nuanced responsibilities of rental property ownership. A Real Estate agent in Oshawa can provide additional insights into effective management strategies.

Key maintenance considerations include:

- Timely repair and maintenance of property infrastructure

- Regular property inspections

- Prompt response to tenant maintenance requests

- Proactive management of potential conflicts

Understanding the Rental Market in Toronto and Durham Region

The rental market in Toronto and Durham Region represents a dynamic ecosystem influenced by complex economic, demographic, and urban development factors. Investors and tenants navigate a sophisticated landscape characterized by rapid transformations and nuanced opportunities.

Market Dynamics and Trends

Rental markets in Toronto, Oshawa, Whitby, Ajax, and Pickering demonstrate unique characteristics that reflect broader regional economic trends. Key market insights include:

- Supply and Demand Fluctuations: Continuous shifts in housing availability and tenant preferences

- Demographic Migration Patterns: Increasing population mobility affecting rental needs

- Economic Growth Indicators: Employment opportunities driving residential choices

Investment Considerations

Explore the comprehensive guide to buying versus renting to understand the intricate decision-making process. A Real Estate agent in Oshawa can provide granular insights into neighbourhood-specific trends.

Investors must consider multiple factors when evaluating rental property potential:

- Proximity to public transportation

- Local infrastructure development

- Neighbourhood growth potential

- Demographic composition

Unlock Your Success in Ontario’s Rental Property Market – Guided by Local Expertise

Navigating rental properties in Ontario is rewarding but comes with unique challenges. This article highlights the need for expert real estate advice on topics like income generation, property management, and choosing the right neighbourhoods across Toronto, Durham Region, Oshawa, Whitby, Ajax, and Pickering. Many investors and homeowners struggle to identify properties with strong rental potential or worry about understanding local regulations and optimizing financial returns. The desire for long-term wealth and passive income is real, but mastering market trends and compliance can be complex. You deserve confidence and clarity on your investment journey.

Are you ready to make informed rental property decisions and unlock new opportunities? Fanis Makrigiannis Realty connects you with tailored property searches, detailed neighbourhood insights, and personalized investment guidance. Discover expert resources and tools for buyers and investors on our site and book your one-on-one consultation today. Take the first step to secure your financial future with trusted support from Fanis. Visit https://fanis.ca now and turn your real estate goals into real results.

Frequently Asked Questions

What are the different types of rental properties available in Ontario?

Rental properties in Ontario include single-family homes, multi-unit dwellings, condominiums, and townhouses. Each type appeals to different investors and tenant needs.

How can I generate income from rental properties?

Income can be generated through monthly rental payments, long-term appreciation in property value, and potential tax deductions on expenses related to property management.

What legal considerations should I be aware of as a rental property owner?

Landlords must comply with legal obligations such as structuring lease agreements, adhering to residential tenancy regulations, and maintaining proper documentation of communications and financial transactions with tenants.

How can I optimize my rental property investment returns?

To optimize returns, investors should select properties in high-demand neighbourhoods, maintain their properties to attract quality tenants, and stay informed about local rental market trends.

Contact me personally to learn more.

About the author:

Fanis Makrigiannis is a trusted Realtor with RE/MAX Rouge River Realty Ltd., specializing in buying, selling, and leasing homes, condos, and investment properties. Known for his professionalism, market expertise, and personal approach, Fanis is a Real Estate agent in the Durham region and is committed to making every real estate journey seamless and rewarding.

He understands that each transaction represents a significant milestone and works tirelessly to deliver outstanding results.

With strong negotiation skills and a deep understanding of market trends, Fanis fosters lasting client relationships built on trust and satisfaction.

Proudly serving the City of Toronto • Ajax • Brock • Clarington • Oshawa • Pickering • Scugog • Uxbridge • Whitby • Prince Edward County • Hastings County • Northumberland County • Peterborough County • Kawartha Lakes

Fanis Makrigiannis

Real Estate Agent

RE/MAX Rouge River Realty LTD

(c): 905.449.4166

(e): info@fanis.ca

Recommended

8 Essential Property Management Tips for Homeowners - Fanis Makrigiannis Realtor®

How to Sell a Rental Property in Toronto & Durham 2025 - Fanis Makrigiannis Realtor®

Top Investment Property Tax Tips for Toronto & Durham 2025 - Fanis Makrigiannis Realtor®

Understanding Property Rental Insurance Terms Clearly - Rental Income Insurance