Top Common Homebuyer Questions in Toronto and Durham 2025

Buying a home in Toronto or Durham has never felt more complicated with shifting markets and new rules. It sounds daunting when you see that the average price in Toronto sits at $900,000 to $1.2 million, while the Durham Region offers options starting closer to $700,000. Yet most buyers fixate on sticker price and overlook the hidden costs and smart strategies that can help them get ahead. The truth is, a single question about tax credits, closing fees, or the right neighbourhood could save you thousands or open doors you never considered.

Key Homebuyer Questions in Toronto and Durham

Financial Considerations for Local Homebuyers

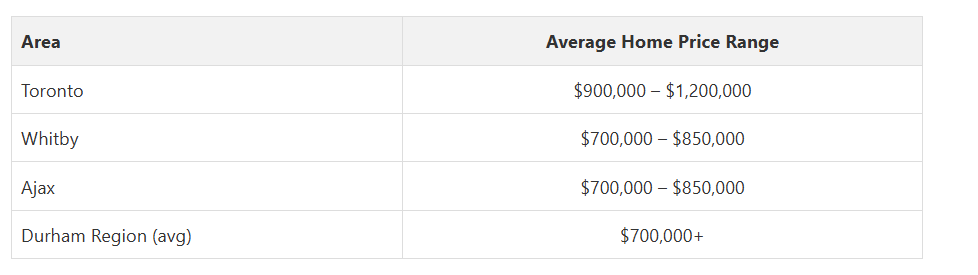

The average home price in the Durham Region varies significantly between municipalities. In Toronto, prices typically range from $900,000 to $1.2 million, while nearby areas like Whitby and Ajax offer more affordable options between $700,000 and $850,000. Potential buyers must carefully assess their budget, considering not just the purchase price but also additional expenses such as land transfer taxes, legal fees, and home inspection costs.

To help buyers compare average home prices across Toronto and key Durham Region municipalities, review the following summary of current ranges:

Legal and Procedural Homebuying Questions

Home buyers in the Durham Region often ask about the offer process, closing costs, and necessary documentation. Working with a professional realtor like Fanis Makrigiannis can help navigate these complex procedures. Essential documents include proof of income, credit reports, mortgage pre-approval, and a comprehensive home inspection report.

Market Insights and Strategic Buying

Market volatility remains a significant concern for potential homeowners. Recent trends indicate a stabilizing market in the Toronto and Durham regions, with more balanced conditions compared to previous years. Buyers should remain flexible, conduct thorough research, and be prepared to act quickly when the right opportunity presents itself.

Professional guidance from experienced realtors can transform the homebuying experience. By asking the right questions and understanding local market dynamics, buyers can make informed decisions that align with their long-term financial and lifestyle goals.

Understanding Regional Real Estate Trends and Values

Regional Price Dynamics and Market Segmentation

Neighbourhood-specific factors significantly impact property valuations. Areas like Whitby and Pickering offer unique investment potential, driven by infrastructure developments, proximity to transportation corridors, and emerging commercial zones. Buyers must consider micro-market characteristics beyond broad regional trends, evaluating individual neighbourhood performance and future growth potential.

Economic Factors Influencing Property Values

Investment potential varies across different property types. Condominiums in downtown Toronto maintain different appreciation trajectories compared to detached homes in Durham’s suburban municipalities. Professional guidance from experienced realtors like Fanis Makrigiannis becomes crucial in navigating these complex market dynamics.

Emerging Market Trends and Future Projections

“Every market has opportunities — the key is knowing where to look.” Fanis Makrigiannis, Real Estate Agent RE/MAX Rouge River Realty Ltd.

The Durham Region demonstrates resilience through diversified economic foundations. Manufacturing, technology sectors, and educational institutions provide consistent economic support, mitigating potential market volatilities. Prospective buyers should view real estate investments through a comprehensive lens, considering not just current market conditions but potential long-term transformations.

Successful real estate strategies in Toronto and Durham require continuous learning, adaptable approaches, and a deep understanding of local market nuances. By remaining informed and working with knowledgeable professionals, buyers can make strategic decisions that align with their financial goals and lifestyle preferences.

Tips for Choosing the Right Realtor and Services

Evaluating Professional Credentials and Experience

Look for licensed professionals with specific experience in Toronto and Durham Region markets, including municipalities like Oshawa, Ajax, Whitby, and Pickering.

Key credentials to examine include:

- Provincial real estate licensing

- Professional memberships

- Specialized certifications

- Years of experience in local markets

- Track record of successful transactions

A realtor like Fanis Makrigiannis brings comprehensive regional knowledge, understanding the nuanced dynamics of different neighbourhoods and property types.

Essential Services and Client Support

Critical services to expect from a professional realtor include:

Beyond professional credentials, personal compatibility plays a crucial role in selecting the right realtor. The Utah Association of REALTORS emphasizes the importance of finding a professional who understands your specific needs and communication preferences.

- Detailed market research

- Property valuation insights

- Comprehensive buyer representation

- Negotiation strategy development

- Transaction documentation management

- Post-purchase support

Communication and Personal Compatibility

Recommended strategies for assessing realtor compatibility include:

- Initial consultation meetings

- Discussing communication expectations

- Understanding their approach to client representation

- Reviewing client testimonials

- Checking professional references

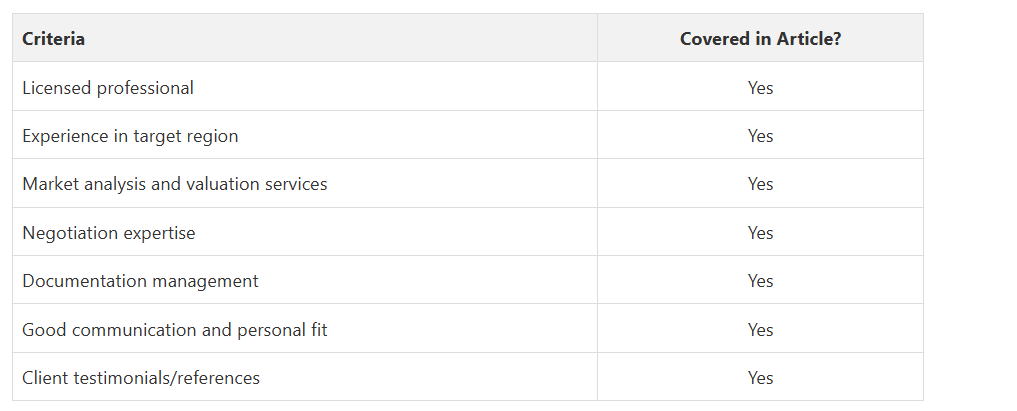

Choosing the right realtor is essential. Review this checklist of key criteria and services to evaluate when selecting a professional in the Toronto and Durham area:

Use this table as a guide when interviewing or researching local real estate agents. The right realtor acts as a strategic partner, guiding you through complex real estate transactions with expertise, transparency, and personalized support. In the dynamic Toronto and Durham Region markets, choosing a knowledgeable professional can make the difference between a challenging experience and a successful property acquisition.

Remember that your realtor is more than a transactional service provider; they are your strategic advisor in one of the most significant financial decisions of your life. Take time to research, interview, and select a professional who truly understands your unique real estate objectives.

Advice for First-Time Buyers and Local Investors

Financial Preparation and Mortgage Strategies

Key financial preparation steps include:

- Establishing a robust credit score

- Saving for a minimum 5-10% down payment

- Exploring first-time homebuyer tax credits

- Calculating total ownership costs beyond purchase price

- Getting mortgage pre-approval

Investors and first-time buyers in Oshawa, Ajax, Whitby, and Pickering should consider unique regional financial considerations. Fanis Makrigiannis recommends understanding local market nuances that impact investment potential.

Investment Strategies and Market Analysis

Strategic investment approaches for the Toronto and Durham Region include:

- Analyzing neighbourhood development plans

- Evaluating property appreciation trends

- Understanding rental market dynamics

- Assessing infrastructure and economic development

- Diversifying real estate investment portfolios

Risk Management and Long-Term Planning

Risk mitigation strategies include:

- Building an emergency financial buffer

- Conducting thorough property inspections

- Understanding local zoning and development regulations

- Exploring property insurance options

- Developing flexible investment strategies

The Toronto and Durham Region offer unique opportunities for first-time buyers and investors willing to approach real estate with careful research, strategic planning, and professional guidance. By understanding market dynamics, financial preparation, and risk management, individuals can make informed decisions that align with their financial goals and lifestyle aspirations.

Remember that real estate investment is a journey of continuous learning. Staying informed, seeking professional advice, and maintaining financial flexibility will be key to navigating the complex and dynamic Toronto and Durham real estate landscape.

Frequently Asked Questions

The average home price in Toronto ranges from $900,000 to $1.2 million, while in the Durham Region, prices are generally between $700,000 and $850,000, depending on the municipality.

What financial assistance programs are available for first-time homebuyers in Ontario?

What are the key legal considerations I should know when buying a home in Durham or Toronto?

How can I effectively evaluate neighbourhoods for buying a home in the Toronto and Durham regions?

Take the Next Step with Local Real Estate Expertise

Explore answers to your biggest questions and discover trusted guidance at https://fanis.ca.

Connect directly with Fanis Makrigiannis and access:

- Up-to-date property listings tailored to your needs

- In-depth neighbourhood insights for Oshawa, Ajax, Whitby, Pickering, and Toronto

- Clear explanations of costs, tax credits, and first-time buyer strategies from an experienced, local Realtor

Contact me personally to learn more.

About the author:

Fanis Makrigiannis is a trusted Realtor with RE/MAX Rouge River Realty Ltd., specializing in buying, selling, and leasing homes, condos, and investment properties. Known for his professionalism, market expertise, and personal approach, Fanis is committed to making every real estate journey seamless and rewarding.

He understands that each transaction represents a significant milestone and works tirelessly to deliver outstanding results.

With strong negotiation skills and a deep understanding of market trends, Fanis fosters lasting client relationships built on trust and satisfaction.

Proudly serving the City of Toronto • Ajax • Brock • Clarington • Oshawa • Pickering • Scugog • Uxbridge • Whitby • Prince Edward County • Hastings County • Northumberland County • Peterborough County • Kawartha Lakes

Fanis Makrigiannis

Real Estate Agent

RE/MAX Rouge River Realty LTD

(c): 905.449.4166

(e): info@fanis.ca