First-Time Buyer Tips for Toronto and Durham Homes 2025

Buying your first home in Toronto or Durham looks exciting and stressful all at once. Everyone hears about high prices and bidding wars in the city. But here is something that may surprise you. Durham homes are about 18 percent cheaper than the Toronto average, making a major difference for first-time buyers. This gap could change where you plant roots, and even how far your money goes in 2025.

Understanding Toronto and Durham Real Estate Markets

Market Dynamics and Regional Differences

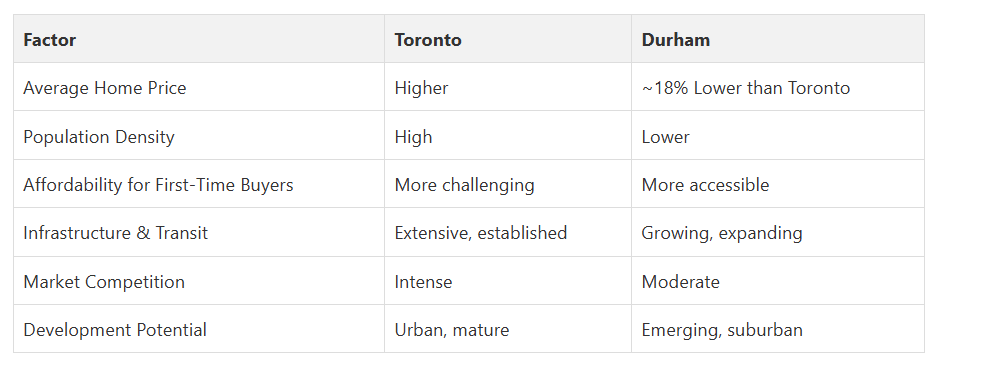

The regional market reveals stark affordability challenges. Research from the Housing Assessment Resource Tools project highlights that nearly 60% of low-income households in Durham are in Core Housing Need. This statistic underscores the critical importance of strategic planning and understanding market dynamics for first-time buyers. To clarify the differences between Toronto and Durham for first-time homebuyers, here’s a comparison table summarizing key factors:

To clarify the differences between Toronto and Durham for first-time homebuyers, here’s a comparison table summarizing key factors:

To clarify the differences between Toronto and Durham for first-time homebuyers, here’s a comparison table summarizing key factors:

To clarify the differences between Toronto and Durham for first-time homebuyers, here’s a comparison table summarizing key factors:Population Growth and Housing Demand

The interplay between Toronto and Durham markets creates a complex ecosystem. While Toronto represents a more expensive, densely populated urban centre, Durham offers more affordable alternatives with growing infrastructure and connectivity. Buyers should consider factors beyond initial purchase price, including:

- Commute potential: Proximity to public transit and major highways

- Community development: Emerging neighbourhoods with growth potential

- Long-term investment considerations: Projected area development and infrastructure plans

Successful first-time buyers will approach the market with a comprehensive understanding of these regional nuances. The ability to compare and contrast Toronto and Durham markets empowers purchasers to make strategic decisions aligned with their financial goals and lifestyle preferences.

Navigating these markets requires thorough research, financial preparedness, and a realistic assessment of individual needs. By understanding the unique characteristics of Toronto and Durham real estate landscapes, first-time buyers can position themselves for successful property acquisition in 2025.

Key Steps for First-Time Home Buyers

Financial Preparation and Assessment

Key financial considerations include:

- Credit score evaluation: Obtain a comprehensive credit report and address any potential issues

- Savings assessment: Calculate required down payment and additional closing costs

- Income stability: Verify consistent income sources and employment history

Prospective buyers should aim to save between 5% to 20% of the home’s purchase price for a down payment. Those with less than 20% will typically need mortgage loan insurance, which adds additional costs to the purchasing process.

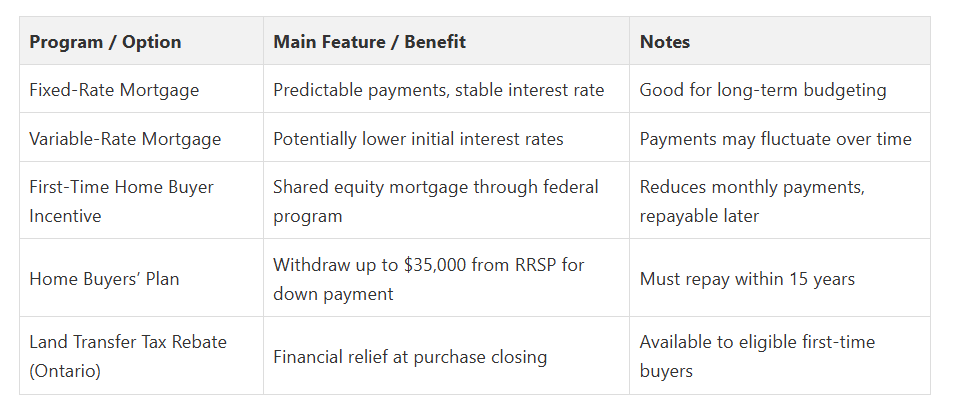

Mortgage and Financing Options

Canadian first-time homebuyers have access to several assistance programs:

- First-Time Home Buyer Incentive: Federal program offering shared equity mortgages

- Home Buyers’ Plan: Allows withdrawal from registered retirement savings plans for home purchase

- Land transfer tax rebates: Specific to Ontario, providing financial relief for first-time buyers

Professional Guidance and Documentation

- Proof of income

- Employment verification

- Credit history

- Bank statements

- Tax returns

Successful first-time home buyers approach the process with patience, thorough research, and a willingness to seek professional guidance. By understanding financial requirements, exploring mortgage options, and preparing comprehensive documentation, buyers can confidently enter the Toronto and Durham real estate markets.

Tips for Selling or Evaluating Property Value

Location and Comparative Market Analysis

- Proximity to essential services: Schools, healthcare facilities, shopping centers

- Neighbourhood quality: Street condition, sidewalk maintenance, and surrounding property aesthetics

- Safety ratings: Local crime statistics and community infrastructure

The sales comparison approach provides a robust method for property valuation. Research from the New York State Department of Taxation and Finance recommends analyzing recent sales of similar properties, adjusting for specific differences in lot size, square footage, home style, age, and unique features.

Professional Valuation Tools and Strategies

- Online valuation platforms

- Professional appraisal services

- Federal Housing Finance Agency price index calculators

- Local real estate market reports

Enhancing Property Value

Critical areas for enhancement include:

- Modernizing kitchen and bathroom spaces

- Improving energy efficiency

- Maintaining consistent property upkeep

- Addressing minor repair and aesthetic issues

- Landscaping and exterior improvements

Emotional appeal, potential for future development, and alignment with local market trends significantly influence a property’s marketability.

Successful property valuation requires a multifaceted approach combining data-driven analysis, professional insights, and strategic improvements. By understanding these complex dynamics, homeowners in Toronto and Durham can make informed decisions about their real estate investments.

Investor Advice for Regional Opportunities

Financial Preparation and Investment Strategies

Key financial considerations for investors include:

- Diversification: Spreading investments across different property types and locations

- Cash flow analysis: Evaluating potential rental income versus ownership expenses

- Long-term appreciation potential: Identifying neighbourhoods with growth prospects

Ratehub.ca highlights several financial tools that can support investment strategies, including tax credits and specialized savings accounts that can optimize investment potential.

Emerging Investment Opportunities

- Emerging neighbourhoods: Areas with upcoming infrastructure development

- Multi-unit properties: Potential for diversified rental income

- Commercial-residential hybrid investments: Opportunities in mixed-use developments

The First Home Savings Account (FHSA) represents a significant opportunity for investors. This Canadian financial instrument allows saving up to $40,000 with tax-deductible contributions and tax-free earnings, providing a strategic financial tool for real estate investment.

Risk Mitigation and Market Analysis

- Conduct thorough market research

- Understand local zoning regulations

- Assess potential renovation or development costs

- Build relationships with local real estate professionals

- Maintain financial flexibility

The Toronto and Durham markets offer distinct advantages for different investment approaches. Urban properties in Toronto present high-density opportunities, while the Durham regions offer more affordable entry points with potential for significant appreciation.

Investors must approach the market with a combination of data-driven analysis and strategic foresight. Understanding regional economic trends, population growth patterns, and infrastructure development can provide a competitive edge in identifying promising investment opportunities.

By combining rigorous financial preparation, strategic market analysis, and a nuanced understanding of regional dynamics, investors can position themselves to capitalize on the unique real estate opportunities presented by Toronto and Durham markets.

Frequently Asked Questions

How can first-time buyers in Toronto and Durham prepare financially?

What mortgage options are available for first-time homebuyers in Canada?

Why is it important to get professional guidance when buying a home?

Take the Uncertainty Out of Your First Home Purchase in Toronto or Durham

If you are ready to make your move, trust Fanis Makrigiannis at RE/MAX Rouge River Realty Ltd. for personalized guidance tailored to your specific needs. Explore expert home buying advice or search current property listings anytime. Do not let hesitation delay your dreams. Connect today for first-hand knowledge, up-to-date listings, and the support you deserve as a new buyer in 2025.

Contact me personally to learn more.

About the author:

Fanis Makrigiannis is a trusted Realtor with RE/MAX Rouge River Realty Ltd., specializing in buying, selling, and leasing homes, condos, and investment properties. Known for his professionalism, market expertise, and personal approach, Fanis is committed to making every real estate journey seamless and rewarding.

He understands that each transaction represents a significant milestone and works tirelessly to deliver outstanding results.

With strong negotiation skills and a deep understanding of market trends, Fanis fosters lasting client relationships built on trust and satisfaction.

Proudly serving the City of Toronto • Ajax • Brock • Clarington • Oshawa • Pickering • Scugog • Uxbridge • Whitby • Prince Edward County • Hastings County • Northumberland County • Peterborough County • Kawartha Lakes

Fanis Makrigiannis

Realtor®

RE/MAX Rouge River Realty LTD

(c): 905.449.4166

(e): info@fanis.ca

Recommended

First Home Checklist: Toronto and Durham Region 2025 - Fanis Makrigiannis Realtor®

How to Find a Dream Home in Toronto & Durham Region: 2025 Guide - Fanis Makrigiannis Realtor®

Real Estate Investment: Toronto & Durham 2025 - Fanis Makrigiannis Realtor®

Why Opt for an Online Notary in Ontario - The Online Notary CA

Essential Cleaning for New Homeowners in McKinney 2025