Why Invest in Real Estate 2025: Complete Guide Canada

Over 70 percent of investors now consider real estate a key strategy for long-term wealth in Canada. The market in 2025 looks nothing like it did just a few years ago, with rapid changes in technology and shifting economic conditions redefining how and where people buy property. Understanding these trends is crucial for anyone looking to build wealth or diversify their investments through real estate. This guide helps you navigate the landscape with up-to-date insights and actionable approaches.

Table of Contents

- Defining Real Estate Investing in 2025

- Types of Real Estate Investments Explained

- How Real Estate Builds Wealth Locally

- Risks, Costs, and Taxes in 2025

- Essential Tips With Fanis Makrigiannis Realty

Key Takeaways

Defining Real Estate Investing in 2025

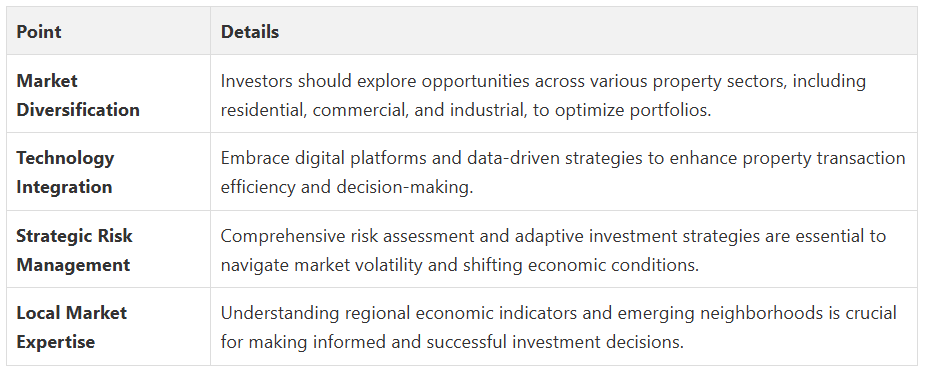

According to the OECD Economic Surveys, Canada’s real estate market in 2025 is characterized by several critical investment dimensions:

- Market Diversification: Opportunities across residential, commercial, and emerging property sectors

- Economic Resilience: Investments aligned with broader macroeconomic policy frameworks

- Technology Integration: Increasing role of digital platforms in property transactions

Fanis Makrigiannis Realty recognizes that modern real estate investing transcends traditional buy-and-hold strategies. The ULI Real Estate Economic Forecast highlights emerging trends that savvy investors must understand. These include adaptive reuse of properties, sustainable development models, and leveraging data-driven investment decisions.

Successful real estate investing in 2025 requires a nuanced approach that balances risk management with strategic opportunity recognition.

Investors must now consider factors beyond simple property appreciation – including environmental sustainability, technological infrastructure, demographic shifts, and regional economic indicators.

By adopting a comprehensive, informed perspective, investors can transform real estate from a passive asset into a dynamic wealth-generation instrument.

Types of Real Estate Investments Explained

According to the Emerging Trends in Real Estate® 2025 report, real estate investments can be categorized into several key sectors:

- Residential Properties: Single-family homes, multi-unit dwellings, condominiums

- Commercial Real Estate: Office spaces, retail centers, mixed-use developments

- Industrial Properties: Warehouses, manufacturing facilities, logistics centers

- Alternative Investments: Data centers, medical facilities, specialized infrastructure

The NAIOP report on commercial real estate highlights that each investment type has a unique risk profile and potential returns. Successful investors in Fanis Makrigiannis Realty understand that each investment type has a unique risk profile and potential returns. Successful investors in Fanis Makrigiannis Realty understand that strategic diversification is key – spreading investments across different property types can help mitigate risks and optimize potential returns.

By understanding the nuanced characteristics of residential, commercial, industrial, and alternative real estate investments, savvy investors can construct portfolios that are both resilient and adaptable to changing market conditions.

How Real Estate Builds Wealth Locally

According to the Financial Accountability Office of Ontario, real estate investments play a crucial role in local wealth generation through multiple economic channels.

These investments stimulate economic activity by:

- Job Creation: Generating employment across construction, maintenance, and related sectors

- GDP Enhancement: Directly contributing to local economic growth

- Infrastructure Development: Spurring ancillary investments in community resources

By exploring Building Passive Income with Real Estate, investors can understand how property investments transcend traditional wealth-building strategies.

The NAIOP analysis of commercial real estate further emphasizes that real estate investments are not just financial instruments but catalysts for community transformation.

In the Durham Region, Fanis Makrigiannis Realty recognizes that local real estate wealth extends beyond individual property appreciation. It’s about creating interconnected economic ecosystems where strategic investments generate ripple effects – supporting local businesses, enhancing property values, and providing sustainable income streams for investors committed to long-term community development.

Risks, Costs, and Taxes in 2025

According to the Financial Accountability Office of Ontario, investors face several critical risk factors in the current market:

- Market Volatility: Unpredictable fluctuations in property values

- Interest Rate Dynamics: Potential shifts in borrowing costs

- Economic Uncertainty: Broader macroeconomic challenges affecting real estate investments

The Understanding Real Estate Risks for Toronto Buyers resource provides deeper insights into navigating these challenges. The OECD Economic Surveys further emphasize the importance of comprehensive risk assessment, highlighting emerging policy challenges and regulatory changes that could impact investment strategies.

Fanis Makrigiannis Realty understands that successful real estate investing in 2025 requires more than just capital – it demands strategic risk management. This means carefully analyzing tax implications, understanding potential cost overruns, and developing flexible investment approaches that can adapt to rapidly changing economic conditions. Investors must now view real estate not as a static asset, but as a dynamic investment requiring continuous monitoring and proactive management.

Essential Tips With Fanis Makrigiannis Realty

According to the SOSCIP research on Ontario’s real estate market, successful investors in 2025 should focus on:

- Regional Market Analysis: Understanding hyper-local economic indicators

- Economic Trend Tracking: Monitoring shifts in employment and infrastructure development

- Strategic Location Selection: Identifying emerging neighbourhoods with growth potential

For investors looking to gain deeper insights, Buying Real Estate with Confidence provides additional resources. The Fanis Makrigiannis Realty approach emphasizes a holistic investment strategy that goes beyond traditional transaction models.

Our methodology integrates comprehensive market research, personalized investment counselling, and proactive risk management. We understand that each investor’s journey is unique, requiring tailored guidance that considers individual financial goals, risk tolerance, and long-term wealth-building objectives. By combining data-driven insights with local market expertise, we help investors transform real estate from a simple asset into a powerful wealth-generation tool.

Unlock Your Real Estate Investment Potential in 2025 with Expert Guidance

Discover how partnering with Fanis Makrigiannis Realty can transform your investment journey. From personalized neighbourhood insights to strategic property listings across Toronto, Durham Region, and beyond, we empower you to invest confidently and maximize your returns today. Start building your real estate portfolio with trusted advice by visiting Fanis Makrigiannis Realty. Explore proven buying strategies and learn more about diversifying your real estate investments to protect your wealth. Take the first step now and secure your future with expert guidance tailored exclusively for 2025’s unique market—visit us at https://fanis.ca to get started.

Frequently Asked Questions

What are the key benefits of investing in real estate in 2025?

How can real estate investment contribute to local economic development?

What factors should investors consider when selecting real estate investments in 2025?

How can I effectively manage risks associated with real estate investing?

About the author:

Fanis Makrigiannis is a trusted Realtor with RE/MAX Rouge River Realty Ltd., specializing in buying, selling, and leasing homes, condos, and investment properties. Known for his professionalism, market expertise, and personal approach, Fanis is a Real Estate agent in the Durham region and is committed to making every real estate journey seamless and rewarding.

He understands that each transaction represents a significant milestone and works tirelessly to deliver outstanding results.

With strong negotiation skills and a deep understanding of market trends, Fanis fosters lasting client relationships built on trust and satisfaction.

Proudly serving the City of Toronto • Ajax • Brock • Clarington • Oshawa • Pickering • Scugog • Uxbridge • Whitby • Prince Edward County • Hastings County • Northumberland County • Peterborough County • Kawartha Lakes

Recommended

- Real Estate Market Trends 2025: What To Expect - Fanis Makrigiannis Realtor®

- Why Real Estate Investing Matters in Toronto & Durham 2025 - Fanis Makrigiannis Realtor®

- Understanding Real Estate Risks for Toronto Buyers in 2025 - Fanis Makrigiannis Realtor®

- Real Estate Investment: Toronto & Durham 2025 - Fanis Makrigiannis Realtor®

- Discover the Canadian Real Estate Scene- Tips for Newcomers