Understanding Mortgage Terms: A Guide for Homebuyers

Buying a home seems like a milestone everyone looks forward to, but the maze of mortgage terms can trip up even the savviest Canadians. Shockingly, even a tiny difference in interest rates could cost or save you thousands over the life of your loan. Most homebuyers focus on the monthly payment, yet it is understanding these hidden terms that actually determines whether you build wealth or end up paying more than you expected.

Table of Contents

- Defining Mortgage Terms: Key Concepts Explained

- Core Mortgage Terminology

- Types of Mortgage Structures

- Legal and Financial Implications

- The Importance of Understanding Mortgage Terms

- Financial Decision Making

- Risk Management Strategies

- Long-Term Financial Planning

- Types of Mortgages and Their Characteristics

- Fixed-Rate Mortgages

- Variable-Rate Mortgages

- Specialized Mortgage Options

- Common Mortgage Vocabulary and Their Meanings

- Fundamental Mortgage Terminology

- Advanced Mortgage Concepts

- Legal and Financial Implications

- How Mortgage Terms Affect Your Financial Decisions

- Short-Term Financial Impact

- Long-Term Wealth Strategies

- Risk Management and Financial Resilience

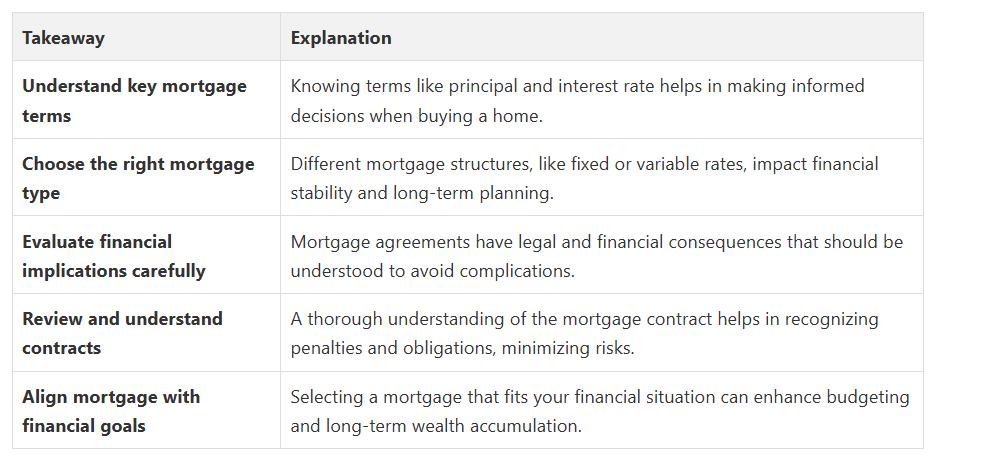

Quick Summary

Defining Mortgage Terms: Key Concepts Explained

Core Mortgage Terminology

Key mortgage concepts include:

- Principal: The total amount borrowed from the lender

- Interest Rate: The cost of borrowing money, expressed as a percentage

- Amortization Period: Total time required to complete full loan repayment

Types of Mortgage Structures

Our guide on understanding mortgage options can help you explore these variations in more depth.

Homebuyers should consider factors like:

- Length of intended property ownership

- Personal financial stability

- Risk tolerance for potential interest rate changes

Legal and Financial Implications

By comprehensively understanding these mortgage terms, homebuyers can confidently navigate the complex real estate landscape, making informed decisions that align with their long-term financial goals.

The Importance of Understanding Mortgage Terms

Financial Decision Making

Key financial considerations include:

- Interest Rate Variations: Minor percentage differences can translate into substantial monetary impacts

- Penalty Clauses: Hidden terms might restrict refinancing or early payment options

- Loan Flexibility: Some mortgages offer more adaptable repayment structures

Risk Management Strategies

Risk mitigation strategies involve:

- Thoroughly reviewing all contractual obligations

- Understanding potential penalty structures

- Evaluating personal financial resilience against potential market fluctuations

Long-Term Financial Planning

By demystifying mortgage terms, you transform from a passive borrower to an active, strategic financial participant in your home ownership journey.

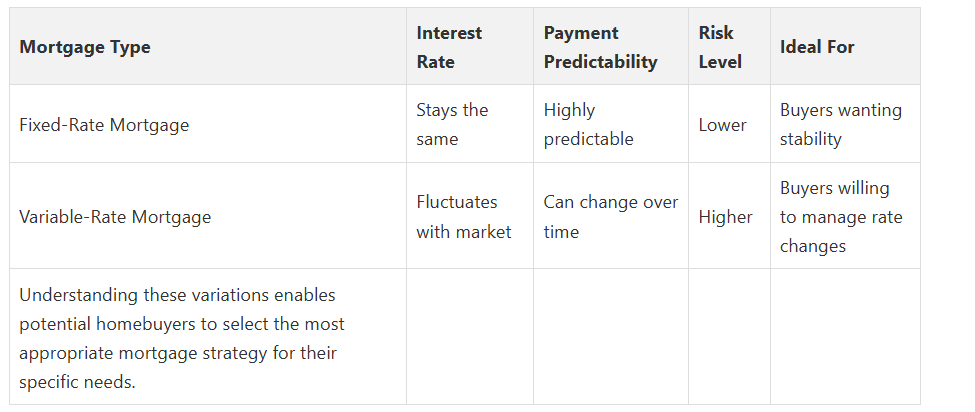

Types of Mortgages and Their Characteristics

The following table compares key characteristics of fixed-rate and variable-rate mortgages to help homebuyers quickly understand the differences between these two main mortgage structures in Canada.

Fixed-Rate Mortgages

Key characteristics of fixed-rate mortgages include:

- Predictable Payments: Monthly mortgage costs remain unchanged

- Long-Term Budgeting: Easier financial forecasting and planning

- Protection Against Market Fluctuations: Interest rates remain constant

Variable-Rate Mortgages

Considerations for variable-rate mortgages:

- Potential for lower initial interest rates

- Higher risk due to potential rate increases

- Requires financial flexibility and risk tolerance

Specialized Mortgage Options

Specialized mortgage characteristics often involve:

- Reduced down payment requirements

- Specific eligibility criteria

- Targeted support for specific buyer segments

Common Mortgage Vocabulary and Their Meanings

Fundamental Mortgage Terminology

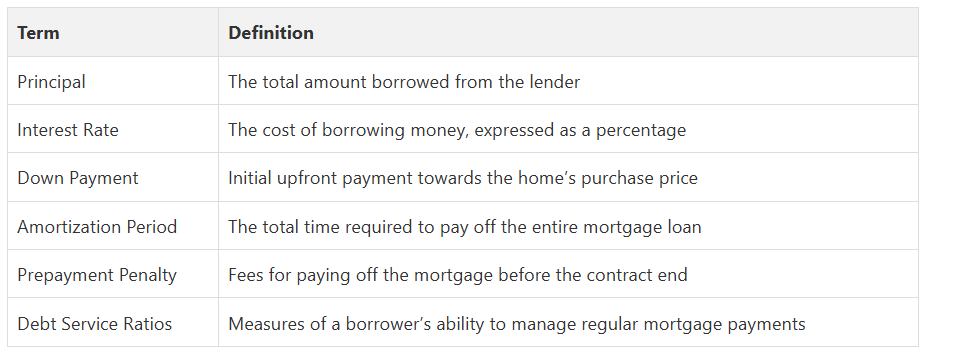

Key foundational mortgage terms include:

- Principal: Total borrowed amount representing the home’s purchase price

- Interest Rate: Percentage charged by lenders for borrowing money

- Down Payment: Initial upfront payment representing a percentage of the home’s total value

Advanced Mortgage Concepts

Critical advanced terms to understand:

- Amortization Period: Total time required to repay the entire mortgage loan

- Prepayment Penalty: Fees charged for paying off a mortgage before contract completion

- Debt Service Ratios: Calculations measuring a borrower’s ability to manage mortgage payments

Legal and Financial Implications

This table provides concise definitions for fundamental and advanced mortgage terminology discussed in the article, enabling homebuyers to reference key terms at a glance.

Important terminology implications involve:

- Precise understanding of contractual obligations

- Recognition of potential financial risks

- Clear comprehension of borrowing limitations

How Mortgage Terms Affect Your Financial Decisions

Short-Term Financial Impact

According to the Bank of Canada, even minor variations in interest rates can translate into substantial monetary differences. Short-term financial implications involve understanding how different mortgage structures interact with your current income, expenses, and financial flexibility.

Key short-term considerations include:

- Monthly Cash Flow: Different mortgage terms directly affect disposable income

- Budget Allocation: Impact on other financial

- commitments and savings potential

- Immediate Financial Stress: Potential strain from high-interest or inflexible mortgage structures

Long-Term Wealth Strategies

Long-term strategic considerations involve:

- Total interest paid over the mortgage lifetime

- Potential equity accumulation rates

- Impact on retirement and investment planning

Risk Management and Financial Resilience

Risk management elements include:

- Assessing personal financial volatility

- Understanding potential economic scenario impacts

- Creating financial buffers through strategic mortgage selection

Take the Stress Out of Mortgage Decisions with Expert Real Estate Guidance

Let Fanis Makrigiannis guide you through these choices step by step. Whether you want up-to-date market insights and home buying tools, advice on your financing strategy, or help comparing properties that match your needs, we make the process clear and manageable. Take control of your journey and make every decision count. Visit https://fanis.ca to schedule a personalized consultation or start your home search today. Get the answers you need now and move forward with confidence.

Frequently Asked Questions

How does the interest rate affect my mortgage payments?

What is an amortization period and how does it work?

Why is it important to understand mortgage penalty clauses?

What are the differences between fixed-rate and variable-rate mortgages?

How can I effectively manage the risks associated with my mortgage?

Contact me personally to learn more.

About the author:

Fanis Makrigiannis is a trusted Realtor with RE/MAX Rouge River Realty Ltd., specializing in buying, selling, and leasing homes, condos, and investment properties. Known for his professionalism, market expertise, and personal approach, Fanis is a Real Estate agent in the Durham region and is committed to making every real estate journey seamless and rewarding.

He understands that each transaction represents a significant milestone and works tirelessly to deliver outstanding results.

With strong negotiation skills and a deep understanding of market trends, Fanis fosters lasting client relationships built on trust and satisfaction.

Proudly serving the City of Toronto • Ajax • Brock • Clarington • Oshawa • Pickering • Scugog • Uxbridge • Whitby • Prince Edward County • Hastings County • Northumberland County • Peterborough County • Kawartha Lakes

Fanis Makrigiannis

Real Estate Agent

RE/MAX Rouge River Realty LTD

(c): 905.449.4166

(e): info@fanis.ca

Recommended

Trusted Realtor® in Toronto, Oshawa & Durham Region | Fanis Makrigiannis - Mortgage and Home Loans

The Home-Buying Timeline in Ontario - Fanis Makrigiannis Realtor®

A Step-by-Step Guide to Buying a Home - Fanis Makrigiannis Realtor®

Olaine's Mortgage Services