Understanding Emerging Real Estate Markets Explained

Emerging real estate markets are catching everyone’s attention lately and for good reason. Some suburbs around the Greater Toronto Area, like Oshawa and Whitby, are seeing property values jump much faster than in Toronto’s core. That sounds exciting, but most people assume these areas are just cheaper alternatives. The real surprise is that these markets are turning into hubs of economic growth, drawing in new businesses and delivering long-term value few would expect.

Table of Contents

- What Are Emerging Real Estate Markets?

- Defining Characteristics Of Emerging Markets

- Investment Potential And Market Dynamics

- Why Do Emerging Real Estate Markets Matter?

- Economic Growth And Investment Opportunities

- Community Transformation And Infrastructure Development

- Strategic Long-Term Value Creation

- How Emerging Real Estate Markets Work

- Economic Ecosystem And Market Signals

- Investment Mechanism And Value Generation

- Regulatory And Market Dynamics

- Key Concepts Driving Emerging Real Estate Markets

- Economic Transformation And Value Creation

- Investment Ecosystem And Market Signals

- Regulatory And Social Dynamics

- Analyzing Risks And Opportunities In Emerging Markets

- Investment Risk Assessment Framework

- Opportunity Identification Strategies

- Balanced Investment Approach

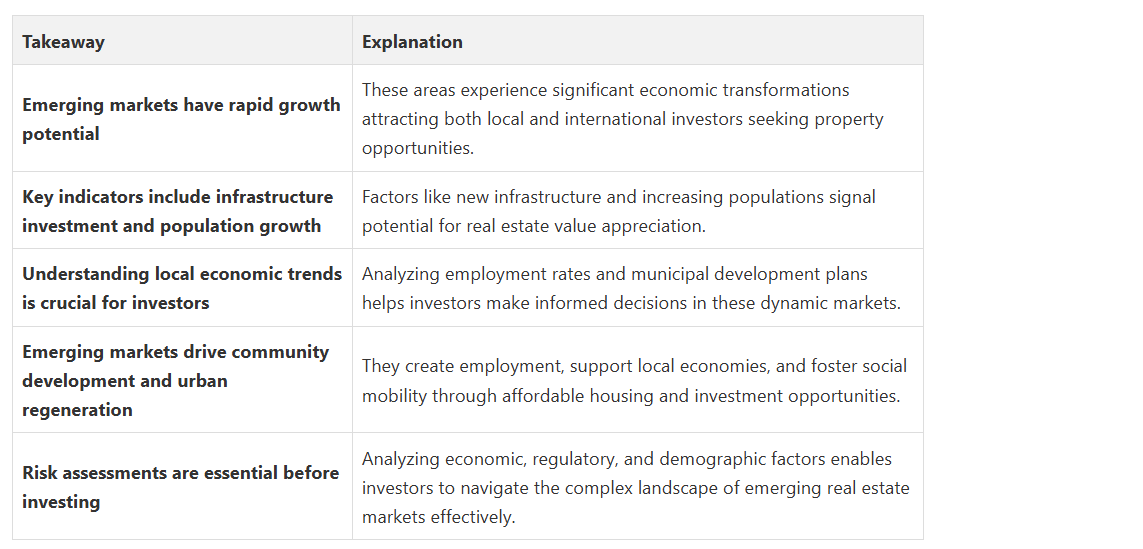

Quick Summary

What are Emerging Real Estate Markets?

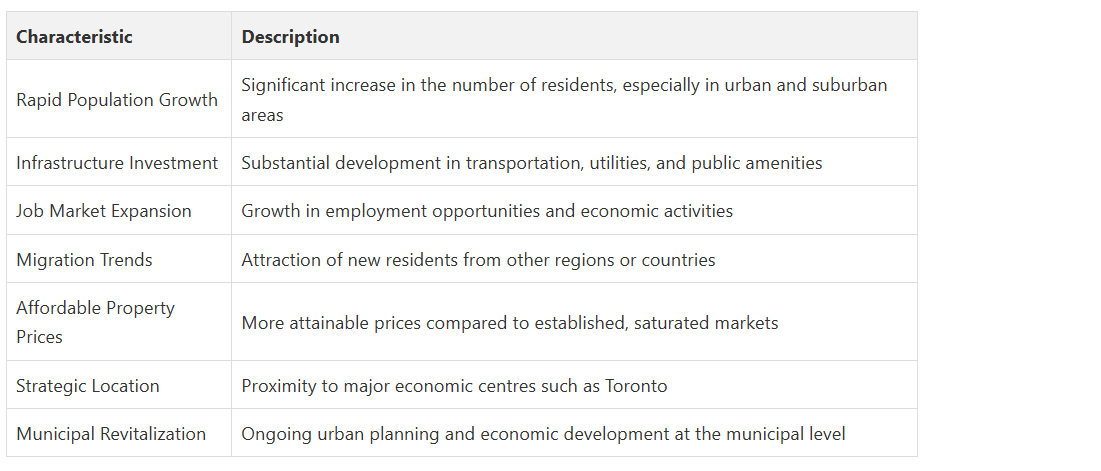

Defining Characteristics of Emerging Markets

- Rapid population growth in urban and suburban regions

- Substantial infrastructure investment and development

- Increasing economic activity and job market expansion

- Positive migration trends attracting new residents

- Affordable property prices compared to established markets

In the context of the Greater Toronto Area and Durham Region, cities such as Oshawa, Whitby, Ajax, and Pickering serve as prime examples of emerging real estate markets. These areas have experienced significant economic revitalization, strategic infrastructure improvements, and growing residential interest.

To help clarify the main characteristics that differentiate emerging real estate markets from other types of markets, the following table summarizes the key defining features discussed in the article.

Investment Potential and Market Dynamics

For those considering property investments in emerging markets like the Durham Region, understanding local economic trends becomes crucial. The region’s proximity to Toronto, ongoing infrastructure developments, and attractive housing prices make it an appealing option for Real Estate agents in Oshawa, professionals and investors seeking growth opportunities.

Key considerations for evaluating emerging real estate markets include analyzing local employment rates, transportation infrastructure, municipal development plans, and projected population growth. By carefully assessing these factors, investors can make informed decisions about potential property acquisitions in dynamic and promising regions.

Why Do Emerging Real Estate Markets Matter?

Economic Growth and Investment Opportunities

- Generating significant capital appreciation

- Diversifying investment portfolios

- Creating opportunities for long-term financial stability

- Supporting local economic development

- Attracting new businesses and talent

In regions like the Durham Region, including cities such as Oshawa, Whitby, Ajax, and Pickering, emerging markets represent strategic investment landscapes with robust potential for growth and development.

Community Transformation and Infrastructure Development

The significance extends beyond financial metrics. Emerging markets contribute to social mobility, providing affordable housing options and enabling individuals and families to build generational wealth through strategic property investments. Explore our insights on regional real estate trends to understand how these dynamics unfold in the Toronto and Durham Region.

Strategic Long-Term Value Creation

These markets demonstrate potential for significant economic transformation, offering advantages that extend far beyond traditional property investment models.

By understanding the complex dynamics of emerging real estate markets, stakeholders can make informed decisions that contribute to personal financial growth and broader community development.

The key lies in recognizing these markets not just as transaction spaces, but as vital ecosystems of economic potential and social progress.

How Emerging Real Estate Markets Work

Economic Ecosystem and Market Signals

- Local and regional economic development initiatives

- Infrastructure investment and urban planning strategies

- Demographic shifts and population growth patterns

- Employment sector expansion and job market trends

- Municipal and provincial policy frameworks

Investment Mechanism and Value Generation

The process typically involves:

- Initial infrastructure and development investments

- Increasing property values driven by demand

- Attraction of new businesses and residents

- Continued municipal and private sector improvements

Regulatory and Market Dynamics

Local governments play a pivotal role by creating conducive environments for growth. This includes zoning regulations, infrastructure development, economic incentives, and strategic urban planning. These regulatory frameworks provide the foundation for market transformation.

The intricate workings of emerging real estate markets represent a dynamic ecosystem where economic potential, strategic investment, and community development converge to create opportunities for growth and prosperity.

Key Concepts Driving Emerging Real Estate Markets

Economic Transformation and Value Creation

- Systematic economic diversification

- Strategic infrastructure development

- Innovative urban planning approaches

- Technological integration in urban spaces

- Sustainable community development strategies

Investment Ecosystem and Market Signals

- Emerging employment sectors

- Population migration patterns

- Municipal policy frameworks

- Local and regional economic initiatives

- Infrastructure investment trajectories

Regulatory and Social Dynamics

The conceptual framework extends beyond traditional economic metrics. Social mobility, community resilience, and sustainable urban development become integral components that transform geographic spaces into thriving real estate ecosystems.

By recognizing these multifaceted concepts, stakeholders can better comprehend the sophisticated mechanisms that drive emerging real estate markets from potential to prosperity.

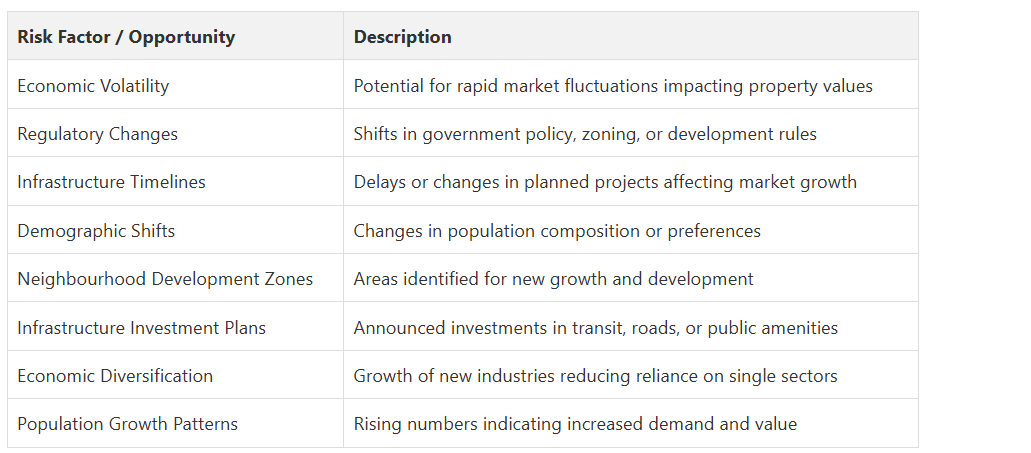

Analyzing Risks and Opportunities in Emerging Markets

Investment Risk Assessment Framework

- Economic volatility and market fluctuations

- Regulatory and policy transformation risks

- Infrastructure development timelines

- Demographic shift implications

- Potential for sudden market corrections

Opportunity Identification Strategies

- Emerging neighbourhood development zones

- Municipal infrastructure investment plans

- Economic diversification indicators

- Population growth and migration patterns

- Technological and industrial sector expansions

Balanced Investment Approach

Comprehensive market analysis demands a balanced perspective that weighs potential risks against prospective opportunities. Investors must develop sophisticated strategies that:- Maintain flexible investment portfolios

- Conduct thorough due diligence

- Understand local market microeconomics

- Develop adaptive investment strategies

- Maintain long-term perspective

By implementing rigorous analytical frameworks, investors can transform potential market uncertainties into strategic advantages.

To support investors and professionals in comparing risks and opportunities within emerging real estate markets, the following table provides an at-a-glance overview of common risk factors and opportunity signals referenced in the article.

The key lies in understanding that emerging markets are not about avoiding risks but effectively managing and leveraging them for sustainable growth.

The key lies in understanding that emerging markets are not about avoiding risks but effectively managing and leveraging them for sustainable growth.Ready to Unlock the Benefits of Emerging Real Estate Markets?

You do not need to figure this out by yourself. Visit Fanis.ca to connect with a local Realtor® who combines hands-on market expertise and real-time listings with personal guidance. Explore tailored home buying and selling resources or dive into detailed neighbourhood insights and market trends to take your next confident step. Growing areas move quickly, and competitive opportunities do not wait. Reach out today and see how Fanis Makrigiannis can help you make the most of dynamic real estate markets—start your journey with Trusted Durham and Toronto Real Estate Solutions now.

Frequently Asked Questions

Why are emerging real estate markets important for investors?

How can one analyze the investment potential of an emerging market?

What risks should investors be aware of in emerging real estate markets?

Contact me personally to learn more.

About the author:

Fanis Makrigiannis is a trusted Realtor with RE/MAX Rouge River Realty Ltd., specializing in buying, selling, and leasing homes, condos, and investment properties. Known for his professionalism, market expertise, :and personal approach, Fanis is a Real Estate agent in the Durham region, is committed to making every real estate journey seamless and rewarding.

He understands that each transaction represents a significant milestone and works tirelessly to deliver outstanding results.

With strong negotiation skills and a deep understanding of market trends, Fanis fosters lasting client relationships built on trust and satisfaction.

Proudly serving the City of Toronto • Ajax • Brock • Clarington • Oshawa • Pickering • Scugog • Uxbridge • Whitby • Prince Edward County • Hastings County • Northumberland County • Peterborough County • Kawartha Lakes

Fanis Makrigiannis

Real Estate Agent

RE/MAX Rouge River Realty LTD

(c): 905.449.4166

(e): info@fanis.ca

Recommended

Real Estate Market Trends 2025: What To Expect - Fanis Makrigiannis Realtor®

Toronto Real Estate Hotspots 2025 - Fanis Makrigiannis Realtor®

Real Estate Technology Trends 2025 for Toronto and Durham Homes - Fanis Makrigiannis Realtor®

Real Estate Market Outlook 2025: Key Trends for Agents - Lead Linker